December 08, 2025

Back to news

Carbon Watch

The SRIA estimates that direct costs to California’s economy from the proposed change would decline from 0.15% of gross state product (“GSP”) in the mid-2020s to zero percent over time. Regarding the projected price per California Carbon Allowance (“CCA”), the SRIA states:

CARB’s messaging is consistent with what ECP believes it intends to achieve as this regulatory change is finalized - i.e., to signal a consistently rising CCA price over time while attempting to avoid price spikes and volatility. If CARB approves the proposed 48% reduction in emissions below 1990 levels by 2030, it will need to remove 265 million allowances from scheduled inventories between 2025 and 2030. This amount is equivalent to approximately one year’s worth of capped sector emissions in California.

May 31, 2024

CARB Releases Long-Awaited Standardized Regulatory Impact Assessment

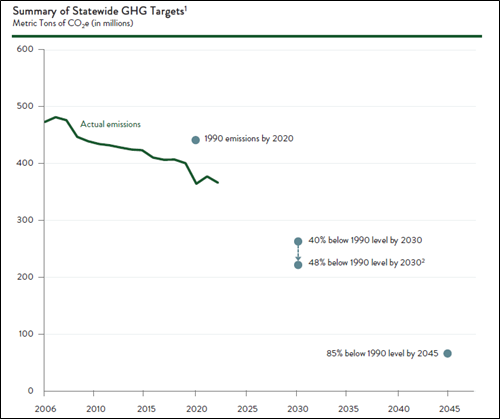

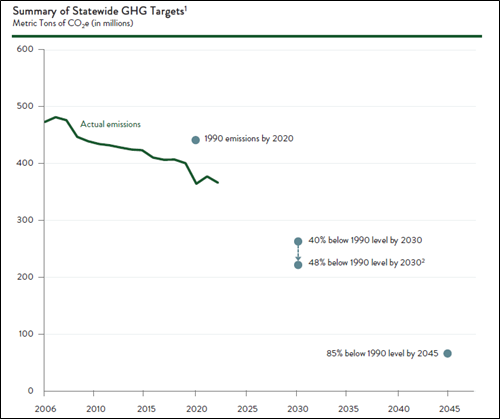

On April 9, 2024, the California Air Resources Board (“CARB”) issued its Standardized Regulatory Impact Assessment (“SRIA”). The SRIA is a statutorily required economic analysis of proposed regulations and its release is a key step in the ongoing process of revising the rules governing the cap-and-trade program in California. The SRIA includes “Proposed Scenario” analysis of the impact of amending the existing cap-and-trade regulation to reduce capped greenhouse gas (“GHG”) emissions in California from the current target (40% below 1990 levels by 2030) to the new proposed target (48% below 1990 levels by 2030). This is consistent with what CARB has stated needs to occur if California is going to achieve its long-term environmental target of an 85% reduction in GHG emissions below 1990 levels by 2045.

California's Historical GHG Emissions and Legislative GHG Reduction Targets

The SRIA estimates that direct costs to California’s economy from the proposed change would decline from 0.15% of gross state product (“GSP”) in the mid-2020s to zero percent over time. Regarding the projected price per California Carbon Allowance (“CCA”), the SRIA states:

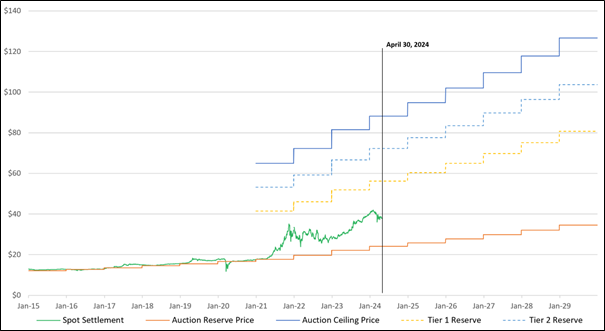

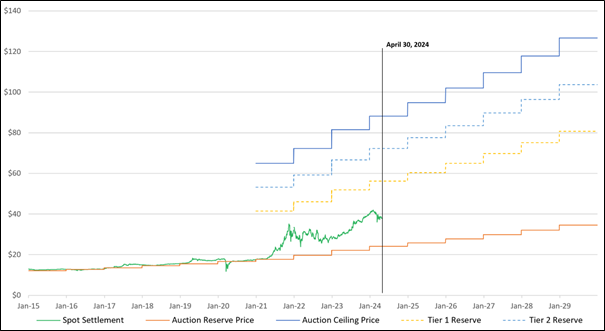

“…while future allowance prices are highly uncertain, and [CARB] staff is unable to specifically predict the extent or timeframe of any allowance price increases due to increased program stringency and uncertainty in performance of complementary policies, staff analysis assumes the average allowance prices during 2025–2046 will fall halfway between the [auction] price floor and the Allowance Price Containment Reserve (“APCR”) Tier 1 price.”

(As a reminder, the auction price floor and the APCR tiers escalate annually at 5% plus CPI—see price chart below for a depiction of what this looks like).

CCA Prices and Future Market Price Mechanisms Under Current Regulation

CARB’s messaging is consistent with what ECP believes it intends to achieve as this regulatory change is finalized - i.e., to signal a consistently rising CCA price over time while attempting to avoid price spikes and volatility. If CARB approves the proposed 48% reduction in emissions below 1990 levels by 2030, it will need to remove 265 million allowances from scheduled inventories between 2025 and 2030. This amount is equivalent to approximately one year’s worth of capped sector emissions in California.

The likely “buckets” from which CARB would subtract these 265 million allowances include the Price Ceiling (78 million), APCR Tier 1 (67 million), APCR Tier 2 (90 million), and the 2025-2030 auction/free allocation inventories (1,373 million). There are several ways CARB can manage the removal of these allowances from the inventory pool; how it chooses to do so will likely impact whether the goal of steadily rising CCA prices is achieved. It is our view that CARB is likely to draw the allowances from a combination of these “buckets;” in nearly all potential scenarios we anticipate the average annual reduction in allowances to be offered at auction will be materially lower than the currently scheduled 4% annual decline. Thus, the expectation is for a “tighter” market (less supply) moving forward.