December 08, 2025

Back to news

Carbon Watch

Carbon Allowance ETFs, An Overview:

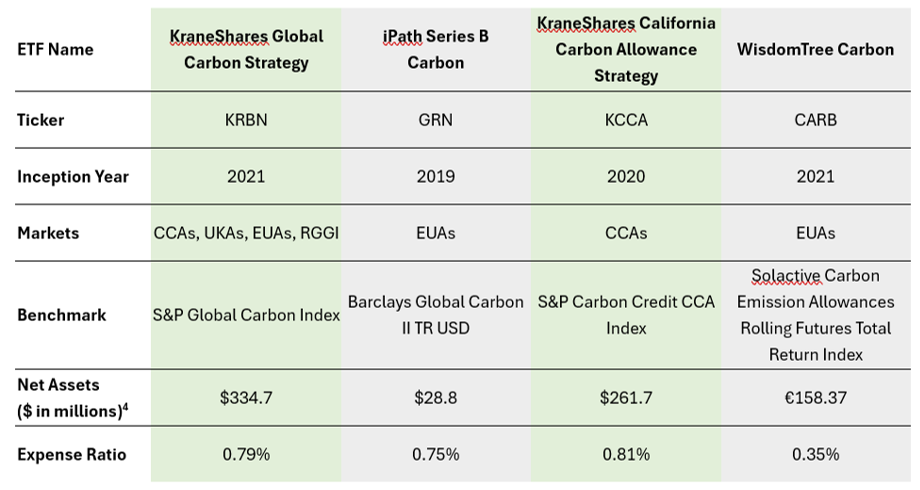

While there are several ETFs in the market that track the price of carbon allowances in some form, growth has been variable. The largest, KraneShares Global Carbon Strategy ETF (KRBN), which is benchmarked against the S&P Global Carbon Credit Index (formally the IHS Markit Global Carbon Index, which tracks carbon credit futures indices and weights holdings based on trading volume), holds net assets of slightly over $330 million, down from above $1.6 billion at YE2021. Like most other ETFs in the sector, the fund holds only futures contracts and is therefore limited to carbon markets where futures contracts are available for trade.

June 30, 2024

Carbon Market ETFs vs. Actively Managed Funds

Investment in carbon markets has increased significantly in the last few years; in 2021, the value of compliance markets worldwide reached over $850 billion, covering close to a fifth of global greenhouse emissions, up from just 5% a decade ago. A variety of carbon market related products and strategies have emerged to access this asset class, catering to both institutional and retail investors.

Carbon Allowance ETFs, An Overview:

Starting in 2019, Exchange-Traded Funds (“ETFs”) became available to investors as a simple way to access the carbon markets. While specific details vary, carbon ETFs are characterized by these fundamentals:

Market Exposure: Concentrated to established markets already trafficked by institutional investors; portfolio rebalancing is infrequent.

Portfolio Diversification: ETFs are either exclusively limited to one market but may participate in up to 4 markets (EUAs, UKAs, CCAs and RGGI). Most tend to be heavily weighted to EUAs (50%+).

Asset Allocation: Driven by market liquidity.

Security Types: Limited to investments in exchange-traded futures, which face negative “roll yield” each year.

Market Exposure: Concentrated to established markets already trafficked by institutional investors; portfolio rebalancing is infrequent.

Portfolio Diversification: ETFs are either exclusively limited to one market but may participate in up to 4 markets (EUAs, UKAs, CCAs and RGGI). Most tend to be heavily weighted to EUAs (50%+).

Asset Allocation: Driven by market liquidity.

Security Types: Limited to investments in exchange-traded futures, which face negative “roll yield” each year.

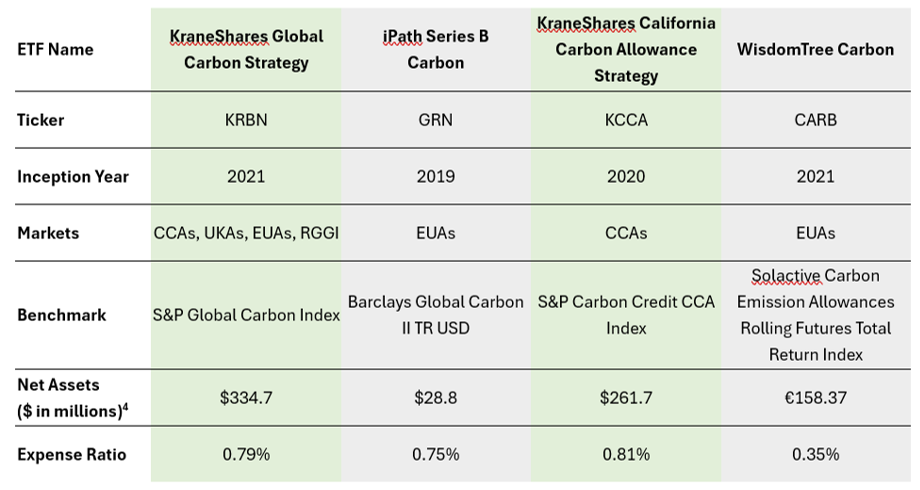

Fees, benchmarks, and other key terms vary, per the chart below:

While there are several ETFs in the market that track the price of carbon allowances in some form, growth has been variable. The largest, KraneShares Global Carbon Strategy ETF (KRBN), which is benchmarked against the S&P Global Carbon Credit Index (formally the IHS Markit Global Carbon Index, which tracks carbon credit futures indices and weights holdings based on trading volume), holds net assets of slightly over $330 million, down from above $1.6 billion at YE2021. Like most other ETFs in the sector, the fund holds only futures contracts and is therefore limited to carbon markets where futures contracts are available for trade.

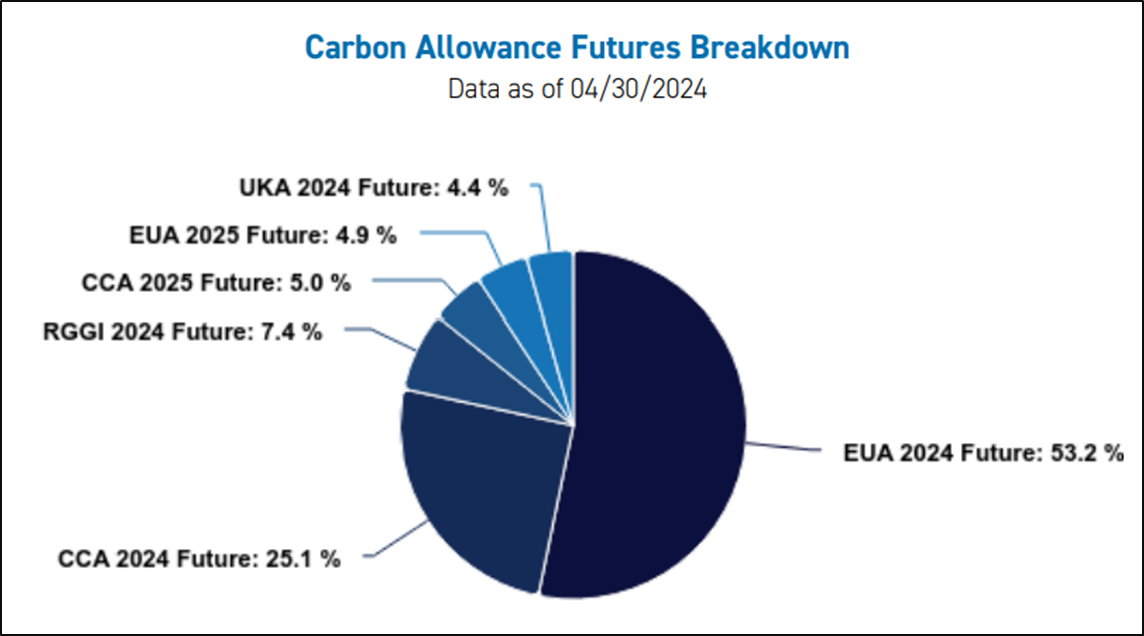

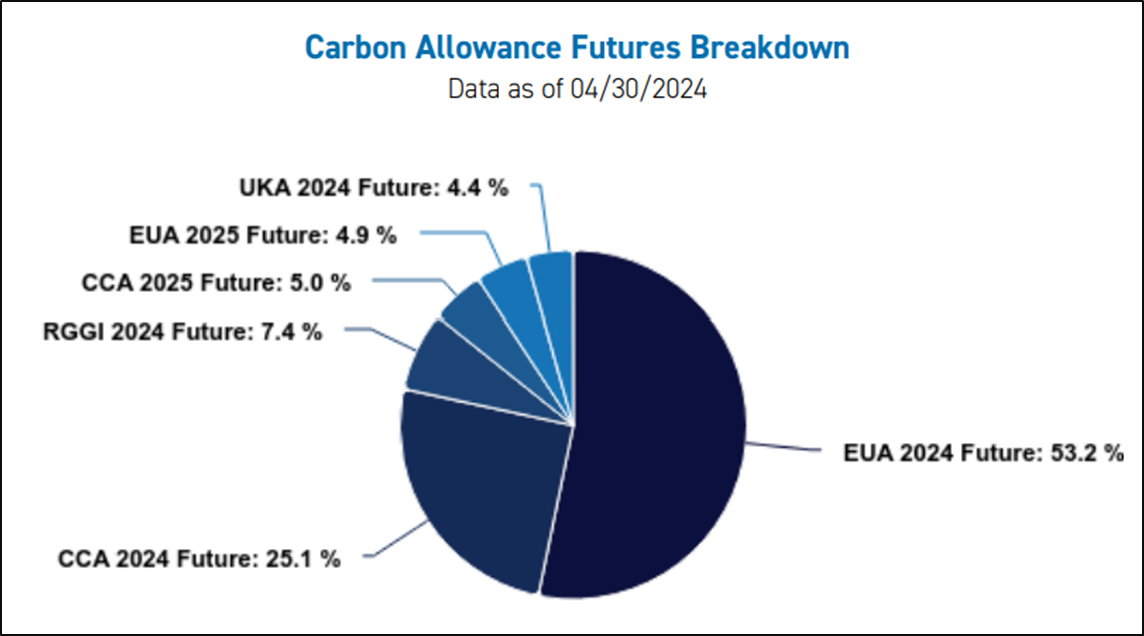

One key aspect governing how a diversified ETF operates lies in its decisions to weight different assets and when to rebalance the portfolio. For example, the KBRN ETF weights assets within the fund based on the liquidity, or average volume traded over the prior six months, of the underlying instrument. As a representation, holdings in KRBN as of April 30, 2024 were as follows:

Actively Managed Strategies; Key Differences

By contrast, actively managed strategies gain exposure to both established and developing carbon markets using multiple instruments and asset types. Allocations are driven by risk/return analysis, and rebalancing is based on market conditions.

One key difference between an actively managed strategy and an ETF is that an actively managed strategy has no mandate to follow a specific benchmark. While an ETF must weight different assets based on their liquidity, or some other predetermined metric, an active strategy is free to invest as it sees fit. For example, ECP invests into environmental commodity markets under four different strategies:

Market Fundamentals: Investing when there is a strong case for directional moves in price based on the underlying supply and demand factors.

Event Driven Strategies: Trading around market-moving events, such as auctions of allowances or market related news.

Regulatory Arbitrage: Trading around regulatory announcements, expected changes to rules in the program(s), or lack thereof. Carbon allowance markets are, by their nature, exposed to regulatory intervention and programming which changes over time, often presenting opportunity to investors.

Relative Value: expressing a view that two markets will converge or diverge in price.

Key Differences between ETFs and Actively Managed Strategies

Market Fundamentals: Investing when there is a strong case for directional moves in price based on the underlying supply and demand factors.

Event Driven Strategies: Trading around market-moving events, such as auctions of allowances or market related news.

Regulatory Arbitrage: Trading around regulatory announcements, expected changes to rules in the program(s), or lack thereof. Carbon allowance markets are, by their nature, exposed to regulatory intervention and programming which changes over time, often presenting opportunity to investors.

Relative Value: expressing a view that two markets will converge or diverge in price.

Key Differences between ETFs and Actively Managed Strategies

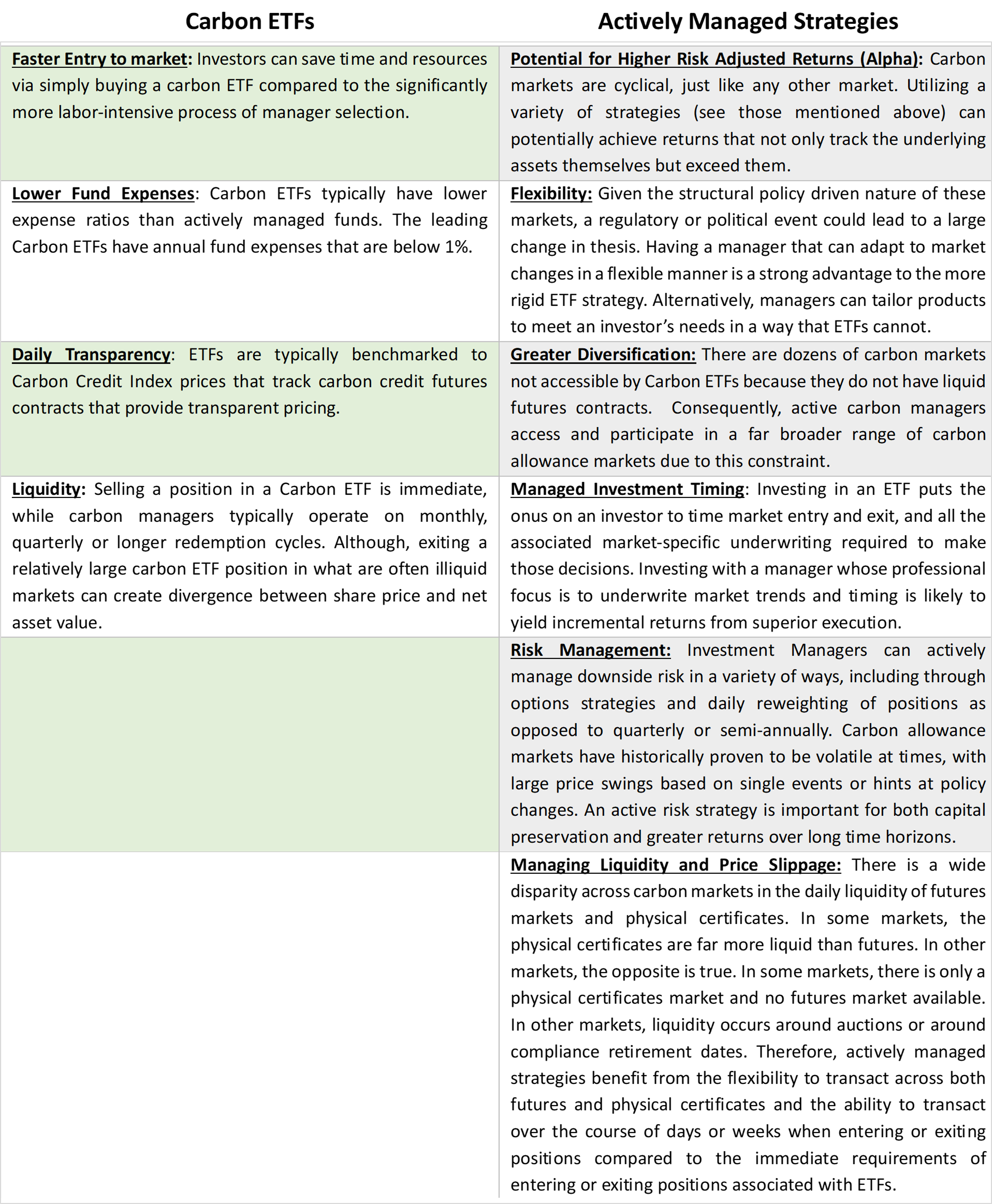

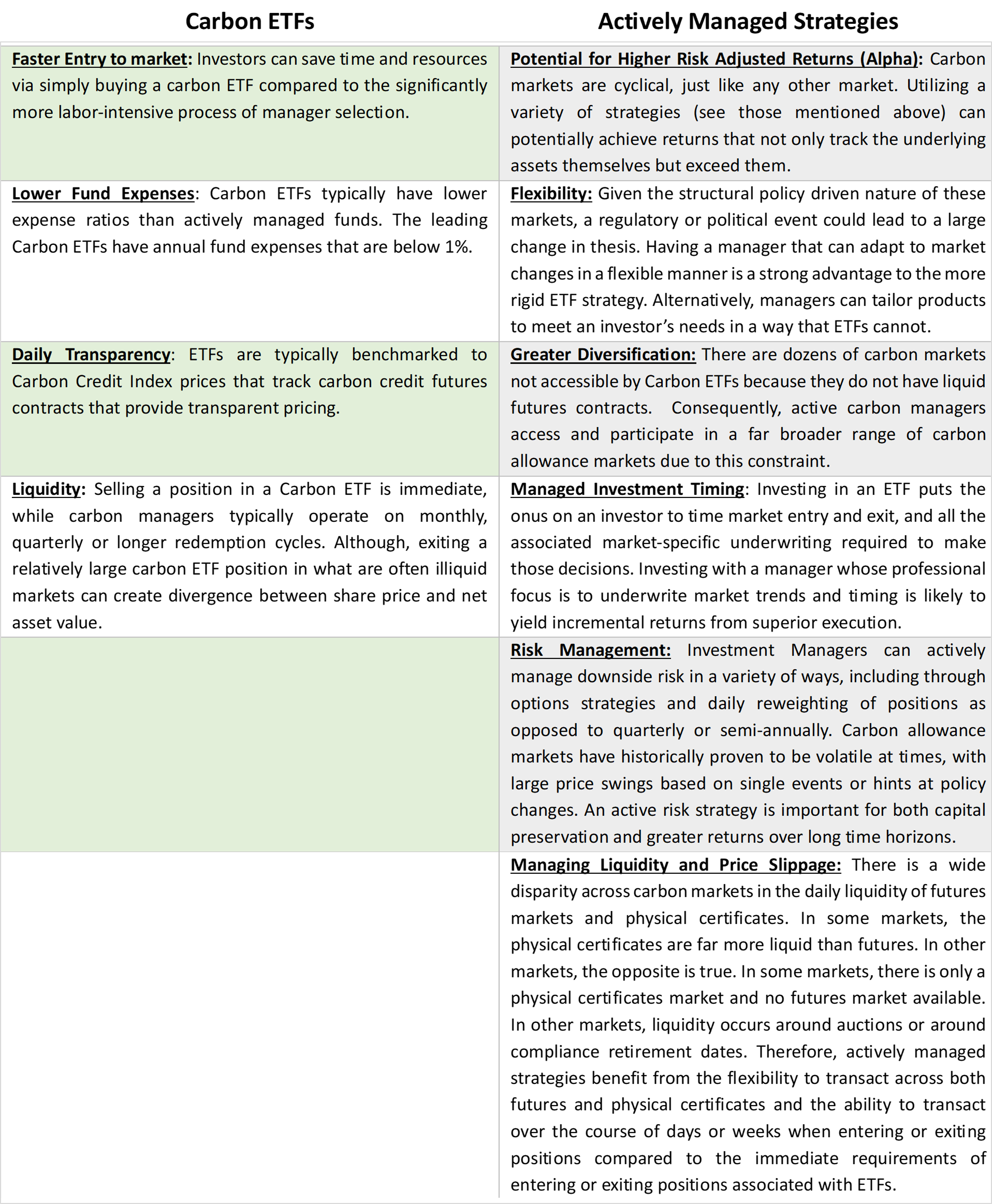

Both ETFs and actively traded strategies have different advantages when investing in carbon allowance markets. The table below highlights the key advantages that ECP identifies for each.

While we generally support all legitimate investment activity into carbon markets, given the reasons highlighted above we believe an actively managed approach will deliver greater risk-adjusted returns over the long term when compared to carbon market ETFs for institutional investors.