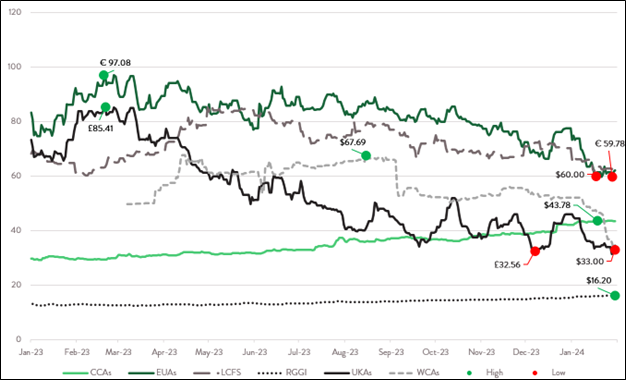

Over the past year, several environmental commodity markets have experienced significant price fluctuations. These price moves have encompassed all-time highs and/or all-time lows within their respective programs.

United Kingdom Emissions Trading Scheme allowances (UKAs) and Washington Cap-and-Invest Program allowances (WCAs) have both reached all-time lows within the last two months. After reaching an all-time high in February of 2023, European Union Allowances (EUAs) ended January below €60, down almost 40% (front-month contract pricing). The California Low Carbon Fuel Standard (LCFS) credits have also reached a low not seen since the early days of the program. Meanwhile, the Regional Greenhouse Gas Initiative (RGGI) and California Cap-and-Trade allowances (CCAs) are trading near, or at, all-time highs.

Selected Environmental Commodity Market Prices (1/1/23 - 1/31/24)

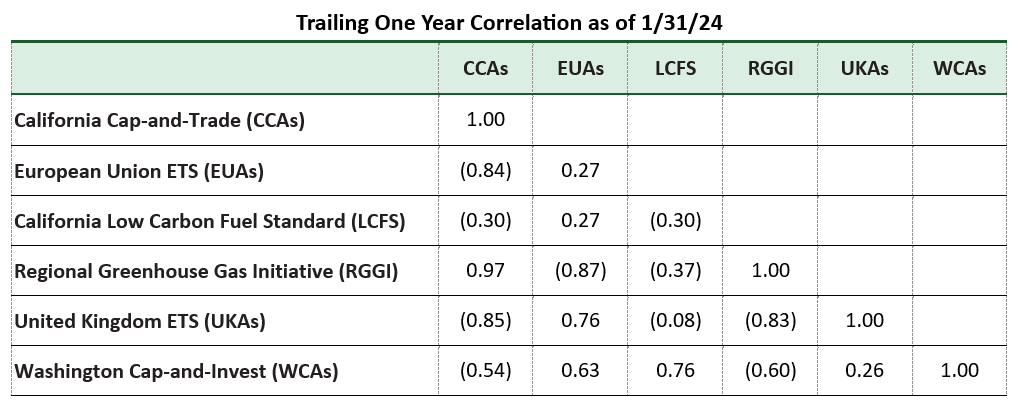

The chart above shows that each of these six major environmental commodity markets reached a noteworthy high or low mark since December of last year. Despite these major price moves happening simultaneously over the last several months, these markets are generally uncorrelated with each other. (They are also uncorrelated with the equity markets and major indices, but that is a topic for another post).

Price action in environmental commodity markets is typically driven by near-term fundamentals of supply and demand, as well as regulatory and/or policy changes that are expected to impact a particular program (e.g., “tightening” of the program to meet more ambitious climate goals).

Many of these markets are inefficient, with near-term fundamentals (bearish or bullish) often driving current prices, even though the longer-term market fundamentals can look quite different. One significant reason for this relative price inefficiency is the market behavior of participants. Emitters, or end-users, are often price-takers in the market – they do not take long-term views on price but rather buy what they need for compliance in the short-term.

These material price movements in 2023 and early 2024 were influenced primarily by regulatory changes (or anticipated changes). Most of these policy modifications were telegraphed via well-considered and appropriately timed communications by experienced regulators; however, in the case of WCAs, the policy change was abrupt, catching many market participants off guard. In all instances, there was a major shift to new pricing levels.

The juxtaposition of highs and lows across different programs within a short span illustrates not just the variability in market responses to shifts in policy or supply and demand, but also the lack of correlation among the markets themselves. The price shifts witnessed in late 2023 and early 2024 all occurred for different reasons and were not tied to broader macro factors that govern equity or commodity markets writ large. Ultimately, success in investing in environmental commodity markets is not about finding a one-size-fits-all strategy but about recognizing and adapting to the unique nuances of each market. A commitment to understanding the granular details that drive market movements though careful underwriting is paramount.