March 13, 2025

Back to news

Carbon Watch

Systematic trading has become established in EUAs in part because of the ease of trading access and concentration of liquidity in a single contract, namely the front-December futures contract. This has enabled many CTAs/macro/energy firms to trade EUAs as a proxy for EU natural gas which has a more complex and volatile term structure. As a result, EUAs are increasingly a component of the typical mainstream “CTA basket” which holds a large number of commodities futures contracts (70-100 on average) across various equity indices, bond futures, commodity futures and currencies.

July 31, 2024

Systematic Trading in Carbon Allowance Markets

ECP underwrites and closely monitors the carbon allowance markets that we invest in, reviewing all activity within them and the potential impact for consideration to our strategy. Recently, we have seen a rise of systematic trading strategies (via Commodity Trading Advisors, or CTAs) interacting with these markets and their subsequent effects. Since their impact is always considered as part of our underwriting and monitoring of each market, this article focuses on CTAs and their activity within carbon markets. While CTAs are a driver of price and trading volume within environmental commodities markets, it is our view that discretionary traders can outperform systematic strategies given the skill and experience required to navigate policy-driven markets like carbon, and CTA activity will likely remain concentrated across a couple of more liquid markets.

CTAs – An Overview

Description: Quantitative trading is a broad category of “systematic” approaches to identifying trade signals from patterns in historical price and non-price datasets that influence a market’s evolution. Systematic trading, most commonly performed by specialist quantitative trading firms called commodity trading advisors (“CTAs”), is generally a strictly rules-based trading approach in which trading occurs without human discretion. Most categories of CTAs and systematic traders are ultimately momentum-based trading systems, looking to identify and enter a trend in price direction and then exit the trade upon the eventual rotation of price momentum away from the trend. CTAs can also deploy a variety of non-trend systems such as mean reversion strategies (for range-bound market regimes), “trend crowding” using non-price data such as weekly Commitment of Trader aggregate trader positioning data, or other “quantamental” strategies.

Signal Types: Price and volume data are the primary inputs to trend following price prediction models. Most trend followers will focus on time-series analysis returns of single instruments, but another approach looks at cross-sectional analysis of different instruments to look for predictive relationships based on correlations. Other CTA models may incorporate concepts like carry, seasonality, mean reverting or pattern recognition systems. Some niche CTAs also trade very short-term signals driven by market microstructure anomalies and patterns.

Performance: CTAs have historically performed well in volatile or crisis periods, and in markets with low correlations between asset classes. Long-term trending markets or extended periods of low volatility have not been as favorable to CTA performance. CTAs struggle in choppy or range-bound markets and can be impacted by sudden market reversals or shifts in macroeconomic conditions.

CTAs & Carbon Markets

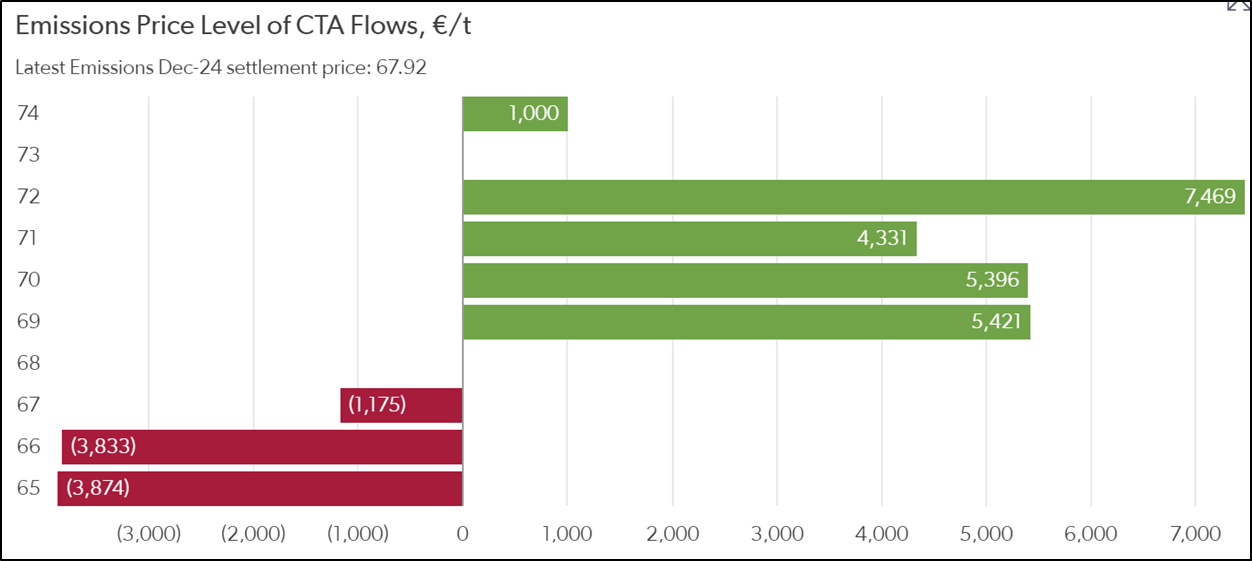

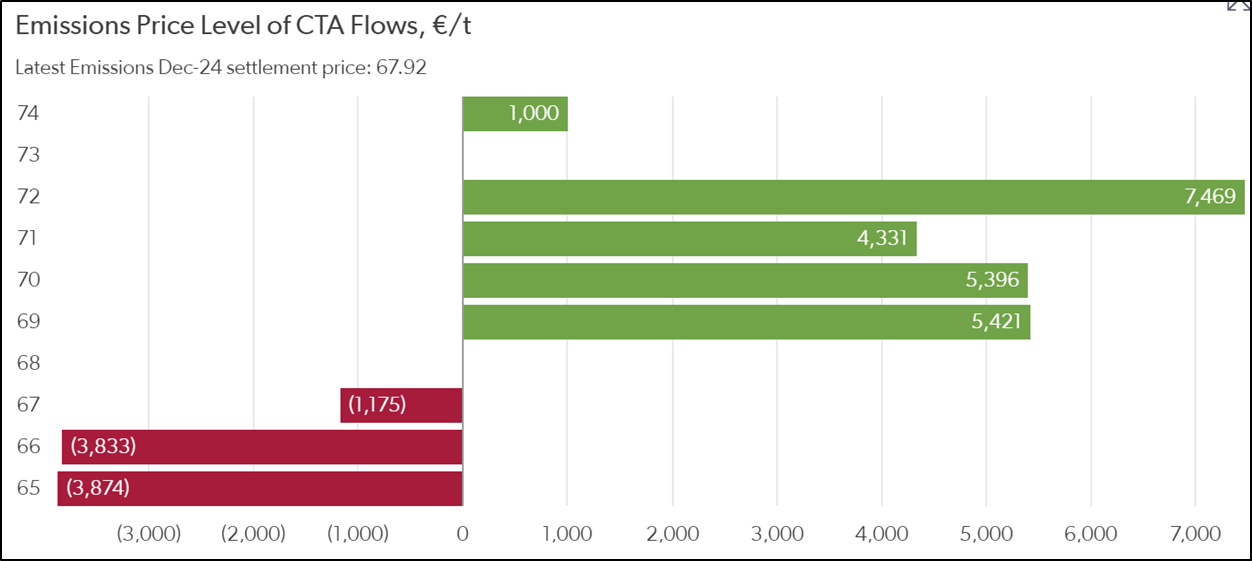

In carbon markets, CTAs are most visible in the European Union Emissions Trading Scheme (“EUA” or “EU ETS”) market, where estimates are that more than half of daily trading is related either to speculative CTAs or to algorithmic execution of EUA procurement programs for utilities. High volatility in the EUA market has attracted CTAs to trade EUAs alongside natural gas and other components of the EU energy complex. As a result, the EUA market has exhibited increasing trend behavior in recent years, especially when systematic trading activity has coincided around major option strike levels exacerbating dealer hedging, or during extended pauses in the daily EUA auctions when the market is less liquid. The chart below illustrates estimated CTA “flipping levels” based on EUA prices where systems are anticipated to reverse positioning, leading to large directional flows of trading that can exacerbate trending price action.

Illustrative long/short CTA trading levels by EUA price

Systematic trading has become established in EUAs in part because of the ease of trading access and concentration of liquidity in a single contract, namely the front-December futures contract. This has enabled many CTAs/macro/energy firms to trade EUAs as a proxy for EU natural gas which has a more complex and volatile term structure. As a result, EUAs are increasingly a component of the typical mainstream “CTA basket” which holds a large number of commodities futures contracts (70-100 on average) across various equity indices, bond futures, commodity futures and currencies.

It is less common to see mainstream CTA in the other carbon markets, as they only have room for a single carbon contract in their instrument universe. Specialist CTAs that do cross-sectional analysis across a larger basket of markets (up to 500) may include carbon markets like California Carbon Allowances (CCAs) or United Kingdom Allowances (UKAs). That said, Given the comparatively illiquid profile of these markets, we generally expect any CTA systems including markets like CCAs to act over longer-range trend or momentum strategies. These frontier CTAs are fewer in nature but can still have disproportionate effects on comparatively less liquid markets like CCAs, especially if they act around option strike levels. For example, it is likely that some level of systematic trading activity contributed to exacerbated price volatility in CCA markets in March and June 2024 as very long-term momentum signals on bullish CCA price action showed signs of exhaustion (exit signal).

As CTAs do not factor in market or policy fundamentals (looking to “back-tested” trading strategies on historic price data instead), they can miss fundamental trade setups, especially those driven by policy dynamics like CCAs are exposed to now. Therefore, CTAs are inherently not a good fit to navigate trading complex, policy-driven markets like carbon. Nevertheless, it is important that ECP continues to monitor and understand how systematic trading strategies impact carbon markets as part of our own activity.