March 13, 2025

Back to news

Carbon Watch

January 31, 2024

The Case for a Differentiated Voluntary Carbon Market

The Voluntary Carbon Market (“VCM”) was valued at approximately $2 billion in 2022, a figure dwarfed by the nearly $1 trillion global compliance carbon markets. This contrast highlights the significant room for growth in the VCM as corporations continue to announce meaningful climate related commitments to reduce their emissions. However, one main question is whether the VCM will become commoditized or will it continue to largely operate in a bilateral, project based, and bespoke manner?

The VCM will resist commoditization for the following reasons:

Intense Corporate Scrutiny: Corporations face significant scrutiny for their claims associated with VCM purchases. The quality of purchased credits is paramount, as low-quality purchases can lead to reputational damage. Companies are keen on ensuring their investments in carbon credits are perceived positively by stakeholders, and thus will maintain an intense focus on the specific projects from which they are purchasing credits.

Inherent Market Fragmentation: The VCM is characterized by diversity – varying by geography, verification body, project type, and credit type. Its heterogeneity challenges the development of a universal standard, as buyers’ preferences are as varied as the credits themselves.

Unique Project Attributes: Projects within the VCM offer differing co-benefits, such as job creation, health improvements, and community engagement. While labels like “CCB” (Climate, Community, and Biodiversity) are intended to provide some quality assurance, the specific benefits each project provides (e.g. jobs created, or dollars returned to the local community) will differ depending on the agreements in place between the project developers, host-countries, and key stakeholders involved.

Desire for Demonstrating Direct Impact: Many corporate buyers want to know their investments/purchases of VCM credits/projects directly lead to beneficial impacts to the environment and communities, which necessitates a project-specific underwriting.

Increased Regulatory Attention: In jurisdictions such as California and Europe, lawmakers are requiring companies to disclose the basis of claims they make regarding net emissions and the use of offsets. Based on this trend, voluntary offset “users” must carefully consider their choice of projects from which to procure offsets.

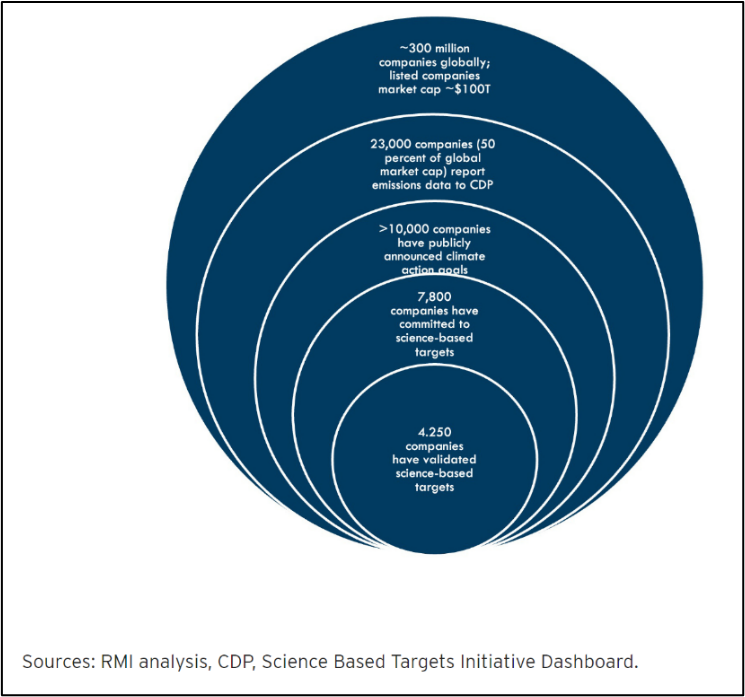

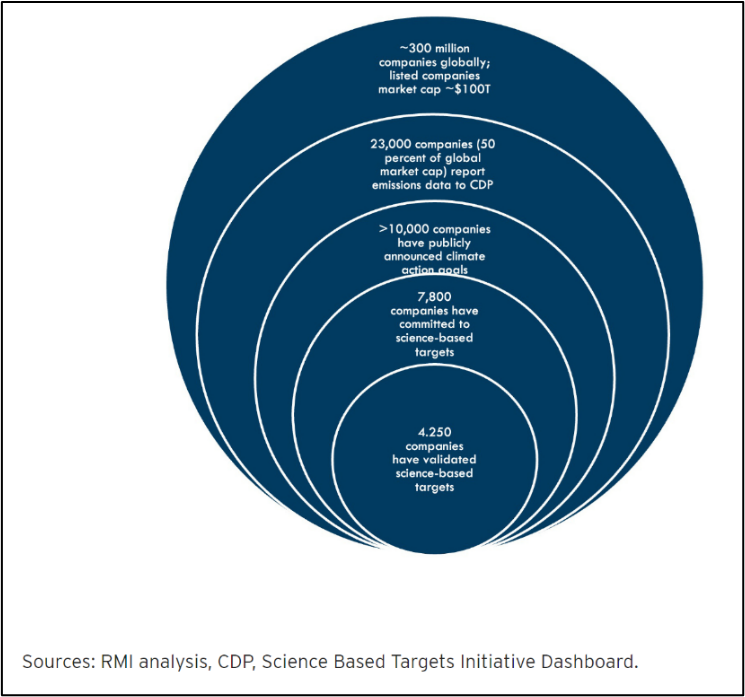

Market Maturity: The VCM is still maturing. Most corporations are yet to actively participate, perhaps deterred by the market’s perceived complexity. While commoditization could theoretically simplify this, it risks incentivizing a focus on cost over quality and impact.

The VCM will resist commoditization for the following reasons:

Intense Corporate Scrutiny: Corporations face significant scrutiny for their claims associated with VCM purchases. The quality of purchased credits is paramount, as low-quality purchases can lead to reputational damage. Companies are keen on ensuring their investments in carbon credits are perceived positively by stakeholders, and thus will maintain an intense focus on the specific projects from which they are purchasing credits.

Inherent Market Fragmentation: The VCM is characterized by diversity – varying by geography, verification body, project type, and credit type. Its heterogeneity challenges the development of a universal standard, as buyers’ preferences are as varied as the credits themselves.

Unique Project Attributes: Projects within the VCM offer differing co-benefits, such as job creation, health improvements, and community engagement. While labels like “CCB” (Climate, Community, and Biodiversity) are intended to provide some quality assurance, the specific benefits each project provides (e.g. jobs created, or dollars returned to the local community) will differ depending on the agreements in place between the project developers, host-countries, and key stakeholders involved.

Desire for Demonstrating Direct Impact: Many corporate buyers want to know their investments/purchases of VCM credits/projects directly lead to beneficial impacts to the environment and communities, which necessitates a project-specific underwriting.

Increased Regulatory Attention: In jurisdictions such as California and Europe, lawmakers are requiring companies to disclose the basis of claims they make regarding net emissions and the use of offsets. Based on this trend, voluntary offset “users” must carefully consider their choice of projects from which to procure offsets.

Market Maturity: The VCM is still maturing. Most corporations are yet to actively participate, perhaps deterred by the market’s perceived complexity. While commoditization could theoretically simplify this, it risks incentivizing a focus on cost over quality and impact.

Despite the potential for increased simplicity and scalability through commoditization, the success of the VCM hinges on the buyers’ ability to discern between projects, allowing those with the highest impact and quality to thrive. In a market where each credit carries a unique story and impact, the value lies not just in offsetting carbon but the broader benefits to the planet and its inhabitants. Maintaining this diversity and depth is crucial for the VCM's meaningful contribution to global climate goals.